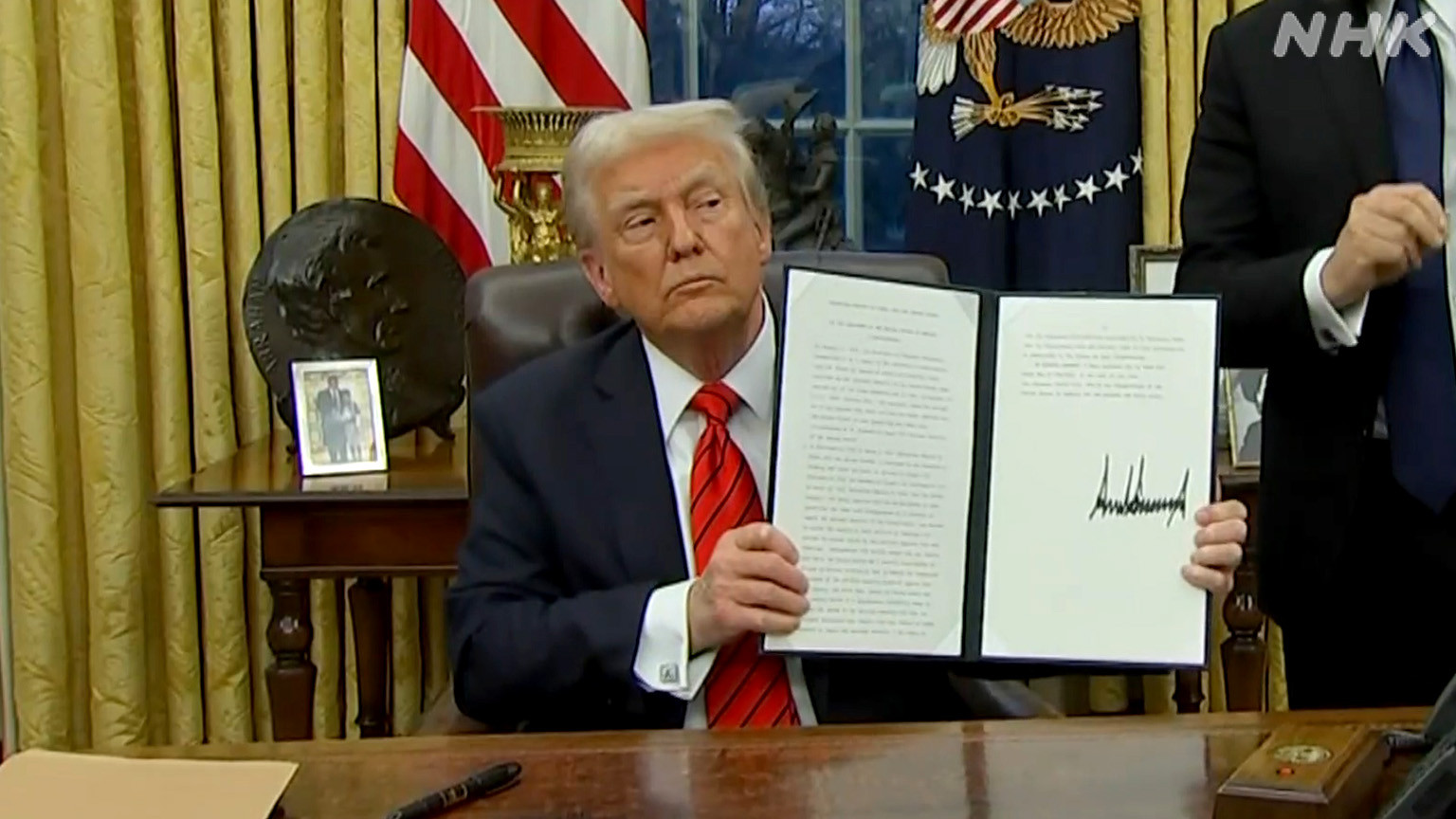

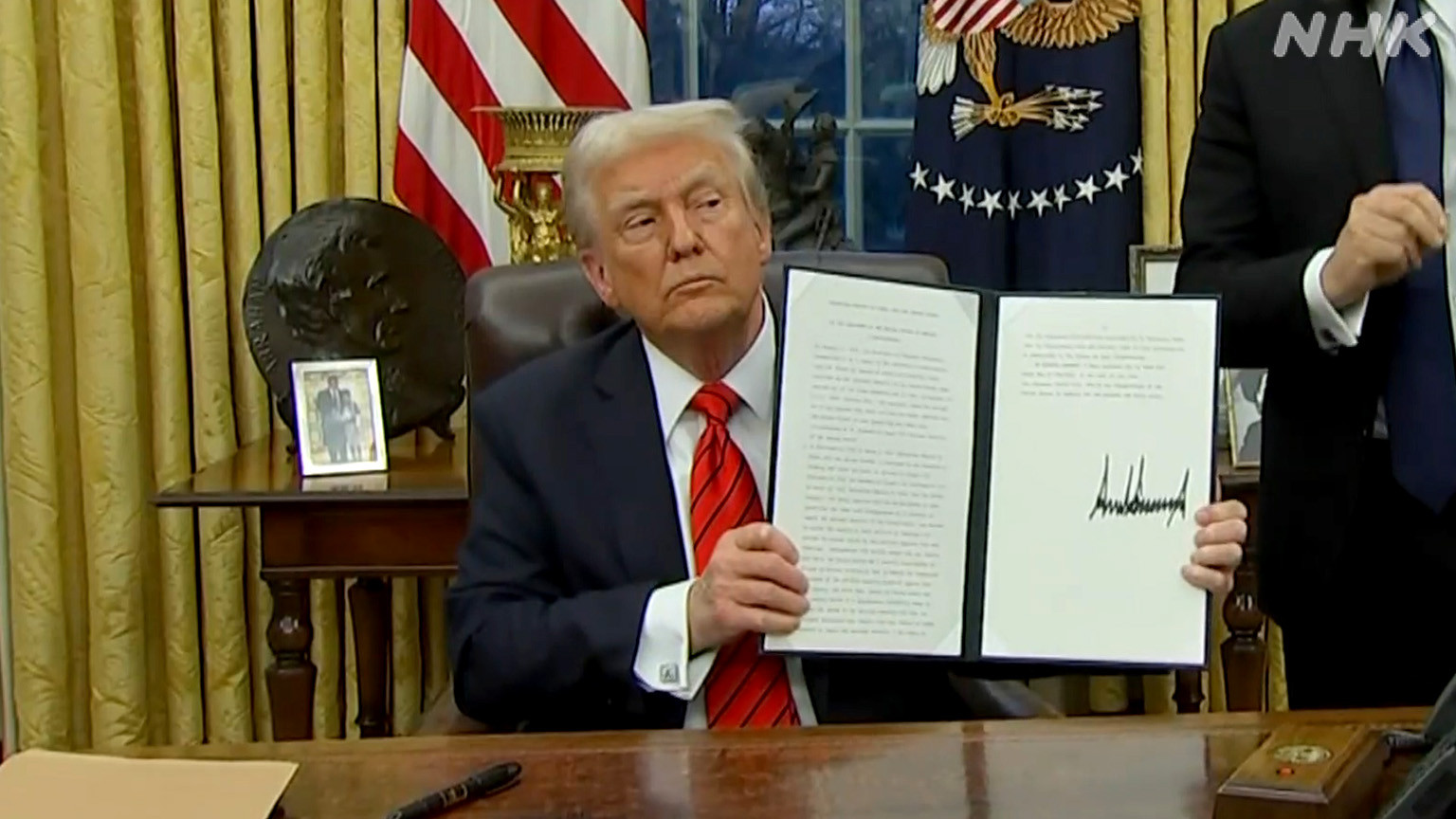

Indian equity benchmark indices slumped on Tuesday as blue-chip stocks tumbled amid uncertainty surrounding U.S. President Donald Trump’s upcoming reciprocal tariffs.

After a weak opening, the BSE Sensex plunged 1,233.95 points to 76,180.97 in late morning trade, while the NSE Nifty dropped 321.5 points to 23,197.85. Heavyweights including Bajaj Finserv, HDFC Bank, Bajaj Finance, Infosys, Axis Bank, HCL Tech, Titan, Tech Mahindra, TCS, and Sun Pharma led the decline.

On the upside, IndusInd Bank surged nearly 5%, and Zomato also traded in the green.

Asian markets fared better, with Seoul, Tokyo, Shanghai, and Hong Kong trading in positive territory. U.S. markets ended mostly higher on Monday, even as investors awaited details of Trump’s tariff strategy. The new reciprocal tariffs, set to be announced on April 2, are being positioned by Trump as “Liberation Day” for the U.S.

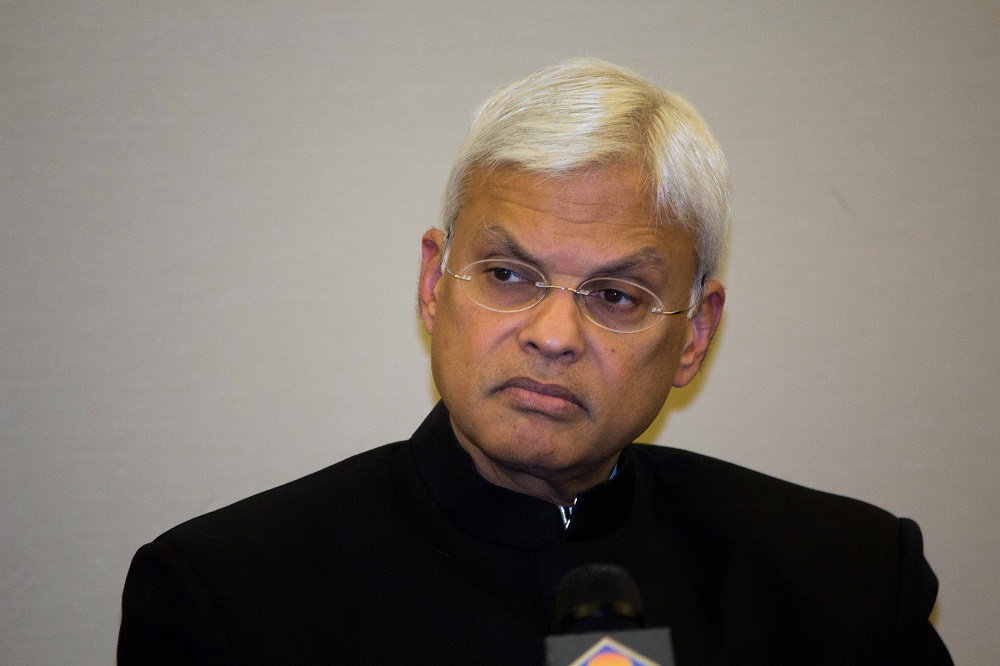

Market analysts believe the tariff announcement will dictate global market trends in the coming days. VK Vijayakumar, Chief Investment Strategist at Geojit Investments Ltd, noted that India's markets performed strongly in March, delivering a 6.3% return. However, he cautioned that future trends will hinge on Trump’s policy details and their impact on global trade.

Foreign Institutional Investors (FIIs) offloaded equities worth ?4,352.82 crore on Friday, further pressuring the markets.

Meanwhile, global oil benchmark Brent crude inched up 0.20% to $74.88 per barrel, adding another layer of market volatility.

On Friday, ahead of the Eid-Ul-Fitr holiday, the Sensex had declined by 191.51 points to close at 77,414.92, while the Nifty slipped 72.60 points to 23,519.35.

With investors on edge, all eyes are now on Trump’s tariff announcement and its ripple effects on global markets.

OpinionExpress.In

OpinionExpress.In

Comments (0)