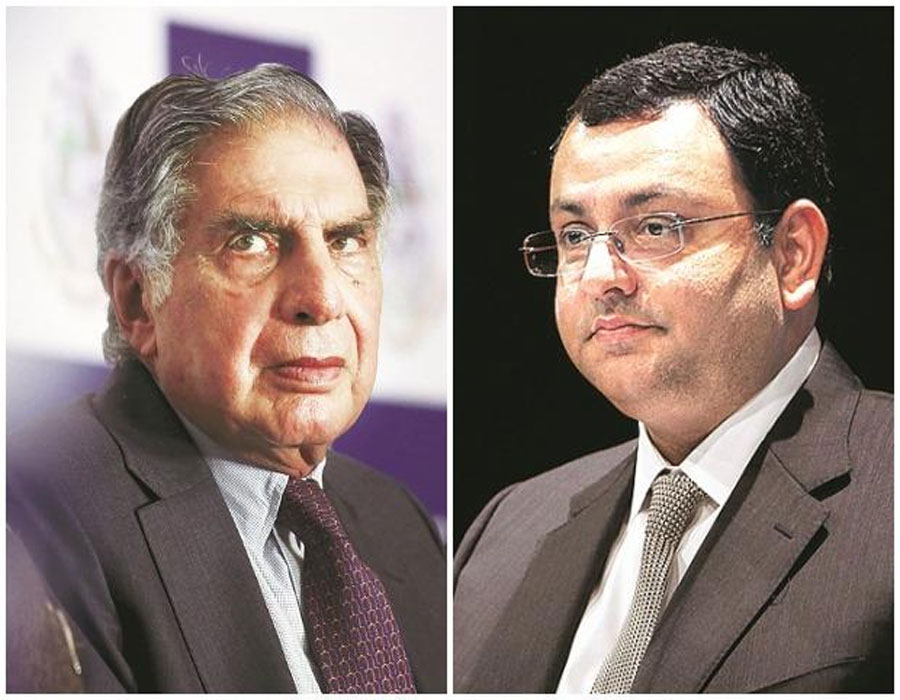

Tata vs Mistry: SC says will finally dispose of matter on Dec 8

The Supreme Court on Wednesday decided to resolve the legal battle related to appointment of Cyrus Mistry as the Executive Chairman of Tata Group on December 8. In December 2019, the National Company Appellate Law Tribunal (NCLAT) had passed the order restoring Mistry as Executive Chairman and held the appointment of Natarajan Chandrasekaran to the post as illegal. On January 10, the apex court had stayed the NCLAT order.

A bench, headed by Chief Justice S.A. Bobde and comprising Justices A.S. Bopanna and V. Ramasubramanian, orally said the matter requires extensive hearing. "We will hear this case on Tuesday as the only matter... list these matters on December 8 for hearing," they said.

On November 18, senior advocate C.A. Sundaram, representing Mistry, had informed the apex court that they have filed an intervention application. Sundaram submitted that the new IA only seeks an additional relief, as the earlier IA did not cover this.

The bench had told Sundaram, "Why have you filed the IA...why don't we got with the final hearing?" The bench reminded him that it had kept the matter on that day for final hearing, yet an IA has been filed. "You file an IA, which requires replies and argument," the Chief Justice said. After a brief hearing in the matter, the top court said: "We will list it for December 2 for final hearing."

On September 22, the Supreme Court had restricted further fund raising by Shapoorji Pallonji group from pledging or transferring Tata Sons shares owned by them till October 28. The top court had said the group should not take any further action on the shares they have already pledged for raising funds. Sundaram, representing the Shapoorji Pallonji group, argued before the bench that the other party is creating havoc on his client's fundraising plans, and the situation is coming to a stage, where they are being blocked in every possible way. Pallonji Group has around 18 per cent shareholding of Tata Sons, and Tata Trusts owns 66 per cent stake in Tata Sons. Counsel for Mistry contended before the bench that banks were refusing to give credit against the backdrop of pendency of this plea, and cited that his client's company has nearly 60,000 employees.

The Pallonji group had argued that there is a clear difference between pledging and transferring of shares, and Tata Sons is advertising the pendency of this plea and it having an impact on the company's effort to restructure loans with banks. Senior advocate Harish Salve, representing Tata Sons, had submitted before the bench that they are creating mischief. Salve argued that if Pallonji group defaults, then banks could sell the pledged shares. Urging the top court to stop the sale of shares, he emphasised that in four weeks, the situation will be beyond repair, if Mistry is not stopped. "If they want to sell, we are willing to buy. Pallonji group must be restricted from raising further funds by pledging shares," he submitted.

At this, the bench noted that it seems Mistry is not ready to maintain the status quo, and directed status quo should be maintained with respect to pledging, transferring, and further action on pledged shares.

OpinionExpress.In

OpinionExpress.In

Comments (0)