With COVID-19 infecting millions worldwide, China is faced with an unprecedented global backlash that could destabilize its reign as the factory of choice for the world. Its neighbor India has felt a chance and is keen to make inroads into a vacuum that China expects will vacate sooner rather than later. In a recent interview, Transport Minister Nitin Gadkari said that China’s weakening global position is a “blessing in disguise” for India to draw further investment. Uttar Pradesh‘s northern province, which has a population of Brazil’s size, is now developing an economic task force to lure businesses willing to leave China. India is also planning a pool of land twice Luxembourg‘s size to sell companies that want to move production out of China, approaching 1,000 American multinationals, Bloomberg said. “This outreach has been an ongoing operation,” Deepak Bagla, Invest India chief executive, the BBC‘s national investment promotion agency, told the government. “For many of those firms, Covid would only accelerate the cycle of de-risking from China.”

The U.S.-India Business Council (USIBC), an influential advocacy organization seeking to improve investment flows between India and the U.S., has said India has stepped up its pitch considerably. “We see India prioritizing efforts to draw supply chains, both at the central and state levels of government,” Nisha Biswal, USIBC President and former US Department of State Assistant Secretary for South and Central Asia, told the BBC. “Companies that already have some manufacturing in India could be earlier movers in the reduction of output in Chinese plants and the rise in demand in India.” But we are still at an assessment stage and it is unlikely that decisions will be taken in haste, she said. In an environment where global balance sheets are fractured, it’s easier said than done to relocate entire supply chains. “Because of the pandemic, many of these companies face severe cash and capital constraints, and will therefore be very cautious before making swift moves,” said independent economist Rupa Subramanya.

According to Rahul Jacob, a long- time China watcher and former head of the Hong Kong Financial Times office, the Indian government setting up land banks is a step in the right direction, but it is unlikely that large corporations will move their operations only because land is made available. “Production lines and supply chains are much more complex than most people tend to realize, and tearing them apart overnight is very hard,” he said. “China offers integrated infrastructure such as large ports and highways, high-quality labor and sophisticated logistics, all of which are critical factors in meeting the stringent deadlines operated by international companies.” India matches the integrated capacities of China’s infrastructure? For large multinationals, another reason India may not be the obvious option is because it is not well integrated with major global supply chains.

Last year, after seven years of negotiation, Delhi pulled out of a key multilateral trade deal with 12 other Asian nations, collectively known as the Global Comprehensive Economic Partnership ( RCEP). Such decisions make it difficult for Indian exporters to benefit from tariff-free access to the destination markets or offer their trading partners reciprocity. “Why would I make something I would like to sell to Singapore in India? Institutionally connecting in trade agreements is as important as offering competitive prices,” Parag Khanna, author of The Future is Asian, told the BBC. He believes that regional integration is especially important, as global trade continues to adopt the “sale where you make” paradigm in which businesses are called “near-source” rather than out-source manufacturing, and bring it closer to demand. The unpredictable relationship between India and foreign direct investment (FDI) and inconsistent regulation is also something that continues to worry global firms.

The fear is that India has used the pandemic to build protectionist walls around itself, from banning e-commerce companies from selling non-essential items and tweaking FDI rules to disallow easier flows of capital from neighboring countries. In a recent address to the country, Indian Premier Narendra Modi made his rallying cry “to be vocal for the local.” Moreover, new policy plans have increased rates for international companies that bid for Indian contracts. “The more that India can strengthen regulatory stability, the better its chances of persuading more global companies to create hubs in India,” Mr. Biswal says. And who else, If not India? Vietnam, Bangladesh, South Korea and Taiwan tend to be favorites to benefit from the backlash against China as things stand. According to Mr. Jacob, the latter two at the “high-tech end of the spectrum” and Vietnam and Bangladesh at the bottom have blamed China for not doing enough to stop coronavirus spread. Owing to rising labor and environmental costs, multinationals started transferring production from China to these countries almost a decade ago.

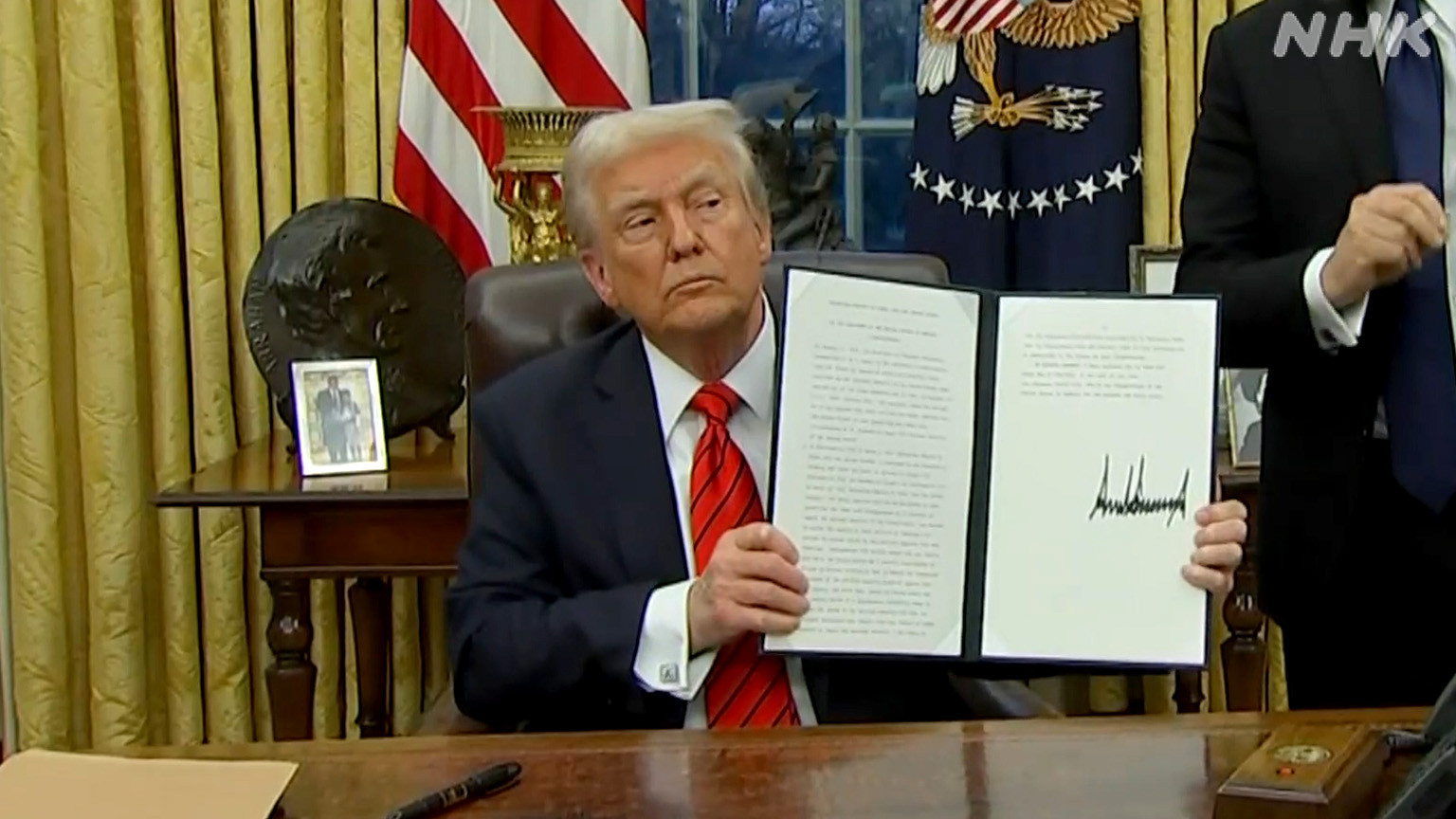

The slow migration has only gathered speed in recent years as trade tensions between the US and China has increased. U.S. imports of goods from Vietnam have increased by more than 50 per cent since June 2018, a month before the trade war started, and those from Taiwan by 30 per cent, according to South China Morning Post newspaper estimates. India is seen as losing out because it failed to establish conditions that would allow multinationals not only to supply the local market, but also to use the country as a production base for exporting to the world. Several states have started to make moves in recent weeks to address some concerns about the ease of doing business-among them making contentious changes to the archaic labor laws of India, put in place to reduce exploitation. For example, the states of Uttar Pradesh and Madhya Pradesh have abolished substantial labor protections that exempt factories from even maintaining basic standards such as cleanliness, ventilation, lighting, and toilets. The aim is to improve the environment of investment and to attract global capital. Yet these decisions may be harmful and harm rather than support, says Mr. Jacob: “” International companies would be very wary about this. They have strict codes of conduct on labor, environment and safety standards for suppliers.”

A turning point was the collapse of the garment factory Rana Plaza in Bangladesh in 2013 which supplied retailers including Walmart. He cautions that it forced Bangladesh to dramatically upgrade factory infrastructure and protection in order to win further investment. “India must follow better standards. These are whiteboard ideas drafted by bureaucrats on Powerpoint that are completely divorced from the reality of global trade.” Yet with the US considering punitive measures against China, Japan charging its companies to move out of the country and UK lawmakers coming under pressure to rethink their decision to enable the Chinese telecoms giant Huawei to play a part in building the country’s new 5 G data network, the global anti-China sentiment is growing. The time is ripe for India to pursue broad-based structural reforms and use these dramatic geopolitical changes to change its worldwide trading relationship.

Ahuti Singh is assistant professor in department of economics in DAV, Banaras hindu university

OpinionExpress.In

OpinionExpress.In

Comments (0)