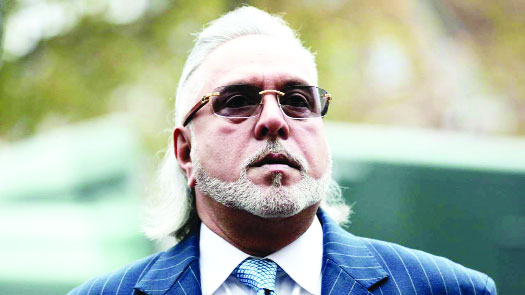

Vijay Mallya lived it up once. The liquor tycoon owned India’s biggest beer brand, which he leveraged into starting an airline by the same name. Simultaneously, he started a calendar that featured India’s top models, including some well-known Bollywood faces of today, whom he gave a break. He was famous for his parties in Mumbai, Goa and Monte Carlo that featured tens of nubile models around his arm and many suspected much more. He called himself the biggest brand ambassador of his airline and booze brands but as the old saying goes, the fastest way to become a millionaire is to be a billionaire and establish an airline. And Kingfisher Airlines cost Mallya a lot — he was forced to sell his brewery and spirits firms to foreign players. The airline collapsed in a mountain of debt, employees lost jobs and a few even committed suicides. It also crumbled with billions of dollars worth of debt with the Indian public sector banks holding the can.

Today, the ruins of Kingfisher Airlines are still visible in Chennai and Mumbai where the once-serviceable planes are rusting away. The impact of the collapse of the airline is also evident on the huge non-performing asset crisis that has overtaken Indian banks. Unlike many other non-performing assets though, Kingfisher Airlines collapsed with nothing left to sell — most of the planes were owned by leasing companies — other than a few buildings and a private jet. To be fair, businesses collapse all the time and to hold people criminally liable for a business failing is unfair. However, to claim that there was no criminal negligence in Kingfisher Airlines’ case is wrong. Mallya used his airline’s brand valued at an obscene amount of money, he was forwarded loans under strange circumstances, leading to speculation that a quid pro quo deal had happened. So, Mallya’s imminent extradition from the United Kingdom should be welcomed and he should be questioned and face criminal proceedings for some of the fraudulent activities that took place. However, to blame Mallya alone would be wrong. Indeed, if he goes to jail, so should the bank officers who lent him money, the consultants that boosted his brand value as well as those politicians, who ensured that banks lent him the money. Mallya should pay if he has committed any crime. The Government’s aggressive new law officers should be commended but Mallya should not become a scapegoat.

Writer and Courtesy: The Pioneer

OpinionExpress.In

OpinionExpress.In

Comments (0)