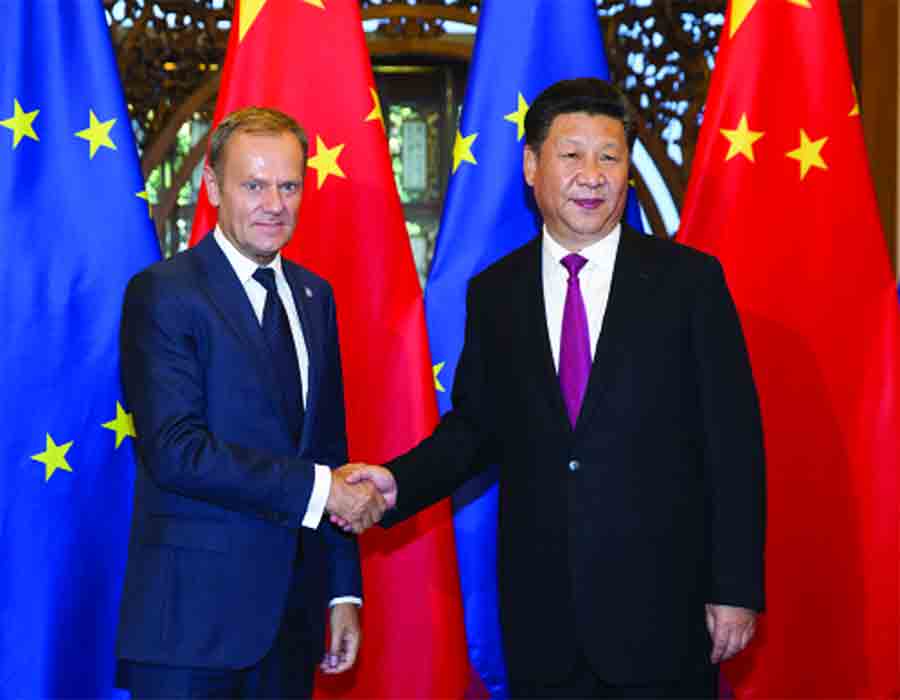

Europe took a long time to see through Chinese strategy of gaining control of strategic assets

From football teams to strategic infrastructures like ports and airports, China's influence in Europe has grown exponentially in under two decades. Chinese companies own four airports including Frankfurt-Hahn Airport in Germany, six ports and a dozen European soccer clubs. By the time Europe started screening Chinese investments in 2019, Beijing's clout had risen manifold. And Italy's endorsement of Xi Jinping's flagship project Belt and Road Initiative gave it the legitimacy it needed. A G-7 European country endorsing a global program did more damage to European unity than any other recent event. The statement of Mario Draghi, Italy's Prime Minister, indicating the possibility of Rome undoing its biggest geo-political blunder in decades, could derail a lot of China's European plans, which were stitched on the back of its seemingly large wallet.

To deepen its access inside Europe, Beijing had focused on Greece and Italy both of whom were struggling with high debt levels. Heavily-indebted Athensfelt it would be better off encashing Chinese cheques than following EU's prescription to cut costs any more. Greece also upgraded its relationship with China a year after the Chinese had gained control of the Greek port of Piraeus. Under Chinese ownership, Piraeus emerged as the second-biggest container port in the Mediterranean and Europe's biggest passenger port. Piraeus' elevation sparked major fears of loss of trade in Rome, causing it to embrace China and the BRI.China successfully exploited the several fault lines that existed in Europe; the one between industrialised North and relatively weaker South. Add to this, the desperate fund crunch of stagnant Southern economies like Italy and Greece which made large Chinese cheques even more appealing. Europe took a long time to see through the Chinese strategy of gaining control of strategic assets, building inroads into prominent think tanks and exploiting the continent's vulnerabilities to build political leverage.

Beijing engaged with each of countries on the European continent. First, China identified weaker economies like Greece and Hungary to break the EU's solidarity. Beijing engaged with non-EU countries like Serbia that were in dire need of capital. It continued to build trade ties with large economies like Germany and the UK. But China never lost sight of its geo-political ambition. The EU failed to speak in a single voice after Beijing lost the case regarding its acquisition of the Scarborough Shoal in international tribunal UNCLOS in 2016. Greece, Hungary and Croatia had thwarted EU efforts to name China despite Manila's unequivocal win at the tribunal. Recognising the need to act against China's lop-sided economic model, ahead of the EU-China summit in 2018, 27 of the 28 EU country ambassadors to China signed a report charging the BRI with pushing "the balance of power in favour of subsidized Chinese companies". Nine months later, however, Italy formally joined the BRI.

In a post-pandemic world order, an increasingly isolated China is seeing the world coming together against it. With America's renewed push to forge trans-Atlantic cooperation to take on Beijing, Draghi's decision could prove to be the biggest reset on the continent. An EU veto on Chinese investments and a revisit on the EU-China investment deal can put intense pressure on Beijing. BRI holds the key to China's power, in Europe and elsewhere. Italy's decision could begin the unwinding.

(The author is a senior journalist and Visiting Fellow at the United Services Institution of India. The views expressed are personal.)

(Courtesy: The Pioneer)

OpinionExpress.In

OpinionExpress.In

Comments (0)