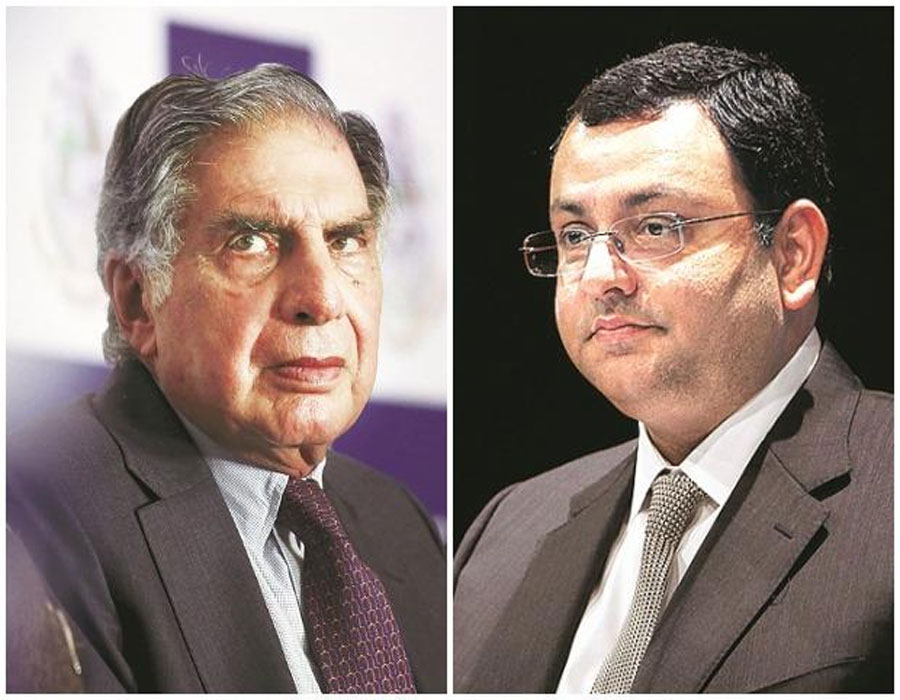

TATA MISTRY BATTLE IN THE FINAL STAGE - SC TO HEAR PETITION ON 8 DEC

by Inputs from Agencies / 03 December 2020Tata vs Mistry: SC says will finally dispose of matter on Dec 8

The Supreme Court on Wednesday decided to resolve the legal battle related to appointment of Cyrus Mistry as the Executive Chairman of Tata Group on December 8. In December 2019, the National Company Appellate Law Tribunal (NCLAT) had passed the order restoring Mistry as Executive Chairman and held the appointment of Natarajan Chandrasekaran to the post as illegal. On January 10, the apex court had stayed the NCLAT order.

A bench, headed by Chief Justice S.A. Bobde and comprising Justices A.S. Bopanna and V. Ramasubramanian, orally said the matter requires extensive hearing. "We will hear this case on Tuesday as the only matter... list these matters on December 8 for hearing," they said.

On November 18, senior advocate C.A. Sundaram, representing Mistry, had informed the apex court that they have filed an intervention application. Sundaram submitted that the new IA only seeks an additional relief, as the earlier IA did not cover this.

The bench had told Sundaram, "Why have you filed the IA...why don't we got with the final hearing?" The bench reminded him that it had kept the matter on that day for final hearing, yet an IA has been filed. "You file an IA, which requires replies and argument," the Chief Justice said. After a brief hearing in the matter, the top court said: "We will list it for December 2 for final hearing."

On September 22, the Supreme Court had restricted further fund raising by Shapoorji Pallonji group from pledging or transferring Tata Sons shares owned by them till October 28. The top court had said the group should not take any further action on the shares they have already pledged for raising funds. Sundaram, representing the Shapoorji Pallonji group, argued before the bench that the other party is creating havoc on his client's fundraising plans, and the situation is coming to a stage, where they are being blocked in every possible way. Pallonji Group has around 18 per cent shareholding of Tata Sons, and Tata Trusts owns 66 per cent stake in Tata Sons. Counsel for Mistry contended before the bench that banks were refusing to give credit against the backdrop of pendency of this plea, and cited that his client's company has nearly 60,000 employees.

The Pallonji group had argued that there is a clear difference between pledging and transferring of shares, and Tata Sons is advertising the pendency of this plea and it having an impact on the company's effort to restructure loans with banks. Senior advocate Harish Salve, representing Tata Sons, had submitted before the bench that they are creating mischief. Salve argued that if Pallonji group defaults, then banks could sell the pledged shares. Urging the top court to stop the sale of shares, he emphasised that in four weeks, the situation will be beyond repair, if Mistry is not stopped. "If they want to sell, we are willing to buy. Pallonji group must be restricted from raising further funds by pledging shares," he submitted.

At this, the bench noted that it seems Mistry is not ready to maintain the status quo, and directed status quo should be maintained with respect to pledging, transferring, and further action on pledged shares.

Market cap-to-GDP ratio currently highest since FY10: Report

by IANS / 02 December 2020The market cap-to-GDP ratio of India is currently highest since FY 2009-10, said a report by Motilal Oswal Institutional Equities.

In its 'India Strategy' report, Motilal Oswal noted that the market cap-to-GDP ratio has been volatile.

From 79 per cent in FY19, it came to 56 per cent in FY20, it said, adding that it is likely to reach 91 per cent in the current financial year.

"The rally since June'20 has led to an Mcap/GDP ratio at the highest levels since FY10," it said.

The lowest level in the last two decades was 42 per cent in FY04. The ratio hit a peak of 149 per cent in December 2007 during the 2003-08 bull run.

The report said that Nifty 50 market-cap continues to trade at all-time highs. Nifty M-cap is currently 13 per cent above December 2019 levels.

However, Nifty Mid-cap 100's market cap is still down 12 per cent from the peak, although it is above December 2019 levels.

It noted that 45 of Nifty50 stocks gained last month. So far in 2020, 31 Nifty stocks have delivered positive returns, said the report.

Further, 182 of BSE-200 constituents gained in November 2020, with 116 stocks posting over 10 per cent gains MoM, leading to a broad-based rally.

So far in 2020, around 120 of BSE-200 constituents posted positive returns, with 45 stocks returning over 30 per cent.

The report also observed that the Indian equity market witnessed a significant dichotomy in November as the domestic institutional investments (DII) logged the highest outflow of funds at $5.9 billion, although net foreign institutional investments (FII) purchase touched an all-time high for any month ever.

"Nov'20 witnessed a dichotomy in flows between FII and DII. FII inflows were at the highest levels at $8.3 billion, while DII sustained the highest net outflows of $5.9 billion," the report said.

Equity indices fall, Sensex down 170 points

by IANS, Mumbai / 02 December 2020The key Indian equity indices declined on Wednesday with the BSE Sensex falling over 170 points.

Healthy buying was witnessed in metal, oil and gas and realty stocks.

Around 10.30 a.m., Sensex was trading at 44,484.90, lower by 170.54 points or 0.38 per cent from the previous close of 44,655.44.

It opened at 44,729.52 and has so far touched an intraday high of 44,729.64 and a low of 44,454.88.

The Nifty50 on the National Stock Exchange (NSE) was trading at 13,077.60, lower by 31.45 points or 0.24 per cent from its previous close.

The top gainers on the Sensex so far were Asian Paints, Tata Steel and Titan Company, while the major losers were Tech Mahindra, Infosys and ICICI Bank.

A DBT for manufacturers

by Subhash Chandra Pandey / 30 November 2020The PLI scheme is result-oriented. The cash incentives will be paid only if the manufacturers make the goods. It is a better alternative

The Central Government has approved production-linked incentives (PLI) for manufacturers in 13 sectors. It essentially means that if an eligible manufacturer produces and sells/exports eligible goods worth Rs 100 crore, the Government will give him Rs 5 crore (assuming five per cent incentive) as a reward/incentive because such sale/export of locally manufactured goods will create local jobs.

The PLI will be available for sale/export for the next five years in addition to the existing incentives. Now this is one of the concerns that remains for investors and would need to be addressed to make the scheme a success. As the PLI benefit has been assured only for five years, the investor has to assess the financial viability of the project beyond the PLI period. Once a manufacturing unit has been set up with a lot of fixed investment, recovery may be difficult. So the five-year period has to be utilised to make life easy for all businesses and job creators. In other words, the “ease of doing business” has to improve substantially.

The Government expects that it may be called upon to pay about Rs 2 lakh crore, which means a total sale/export of about Rs 40 lakh crore (assuming five per cent PLI rate) during the next five years. This PLI will increase local manufacturing of eligible goods by an output equal to about 20 per cent of the current GDP.

Thus, the second concern is changing growth dynamics and the global demand scenario, especially in the post-pandemic world. To get free cash of Rs 2 lakh crore from the Government, specified goods worth about Rs 40 lakh crore would need to be produced in India and a matching demand would be needed in a world where the cut-throat competition is going to deepen.

The third concern is about how much of the PLI benefit would boost the investor’s actual post-tax income. In October, the Ministry of Electronics and Information Technology (MEITY) approved PLI benefits (four per cent to six per cent) to 16 companies. The PLI is available for incremental sales of goods manufactured in India five years subsequent to the base year (FY 2019-20).

Now, whether the incentive of four per cent to six per cent of invoiced price for five years would be enough compensation to offset the cost disadvantage in India remains to be seen. One plus point in favour of the new manufacturing units is 15 per cent corporation tax that was announced last year. For them, manufacturers of highly branded products like Apple iPhones, the PLI scheme and reduced corporate tax are major incentives. Since such manufacturers face little competition for their products, they can set prices of their products on their own. The PLI benefit may or may not be fully passed on to the retail buyers in this particular case.

Most other manufacturers may face stiff price competition and may not be able to fully pocket the PLI benefit to offset their cost disadvantage. Their discerning, hard-bargaining buyers will demand price discounts on the basis of the PLI benefit.

The percentage of PLI benefit may vary across beneficiaries and depending on the competition, the post-tax actual benefit could vary from investor to investor. The PLI scheme, therefore, needs supplementation by sustained investor facilitation and improvement in ease of doing business.

Incentives like income tax and Central excise exemptions, VAT/GST reimbursements, interest and insurance subsidies, subsidies on plant/machinery and so on are typically provided for industries set up in industrially-backward areas like North-eastern states.

At present, the total manufacturing output of all items (whether PLI eligible or not) in a year is about 16 per cent of the GDP. The services sector has a 55 to 60 per cent contribution in GDP and has been a major employer so far.

The PLI will be available to all new manufacturing units and also to existing manufacturing units for their extra production, additional over baseline output. For example, existing mobiles and electronics manufacturers are entitled to PLI benefit for whatever they produce over and above the 2019-20 level production in the next five years. The manufacturing units will have to apply, register and go through a vetting process and enter into proper agreement with the Government so as to ensure that only eligible manufacturers get the incentive for actual local manufacturing.

On April 1, a PLI scheme promising Rs 40,951 crore incentive (four to six per cent of production value) was notified for manufacturers of mobile phones and other electronic components. Medical devices and bulk drugs (active pharmaceutical ingredients) were added to PLI eligibility in July and on November 11, 10 more manufacturing sub-sectors were added.

Thus, Rs 1,97,291 crore of cash incentive has been promised in the next five years to manufacturers of automobiles and auto components (Rs 57,042 crore); mobile manufacturing and specified electronics/technology products (Rs 45,951 crore); advance chemistry cell batteries (Rs 18,100 crore); pharmaceuticals and drugs (Rs 21, 940 crore); medical devices (Rs 3,420 crore); telecom and networking products (Rs 12,195 crore); processed food (Rs 10,900 crore); man-made fibres and technical textiles (Rs 10,683 crore); high-efficiency solar PV modules (Rs 4,500 crore); white goods like ACs and LEDs (Rs 6,238 crore) and speciality steel (Rs 6,322 crore).

For its move in October to approve grant of PLI benefit (four to six per cent ) to 16 companies, MEITY received a very good response from mobile handset manufacturers.

The production of mobile phones surged from about Rs 18,900 crore in 2014-15 to Rs 170,000 crore in 2018-19. Samsung, Foxconn Hon Hai, Rising Star, Wistron and Pegatron have been granted PLI benefit only for manufacturing high-end phones (invoice value Rs 15,000 and above).

Foxconn Hon Hai, Wistron and Pegatron are contract manufacturers for Apple iPhones. They expect to have a major export turnover for high-end phones. Some Indian mobile phone companies, including Lava, Bhagwati (Micromax), Padget Electronics, UTL Neolyncs and Optiemus Electronics, have also been approved for PLI.

This scheme aims to make India a manufacturing hub of global repute, reduce imports and generate employment. It covers both low-value and high-employment items like textiles and food as well as high-value and low-employment items like automobiles, mobiles, electronics, white goods, including high technology items like Advanced Chemical cell battery. Incentivising local manufacture of items like ACC battery, auto and electronics components will help India become part of the global value chains. The automobile industry turnover already accounts for almost half of the total value of manufactured items.

The auto, electronics and pharma industries, which have substantial import dependence and also high export potential, are major beneficiaries of the scheme while textiles and processed food are major employment generators.

A pertinent question is why should the Government give financial assistance of Rs 900 to a phone manufacturing company for every phone sold at Rs 15,000 (assuming six per cent PLI)? After all, more than half of the value of a phone may comprise imported components. The answer to this question is local employment.

The exports, in any case, are tax-free. Under the WTO rules, a Government can refund all taxes collected from exports so that the local taxes are not exported to foreign buyers. So, whatever Customs, excise duties and GST are paid on exported items, they are eventually refunded by the Government. Often, exporters face the problem of working capital if the refund is delayed.

There is a growing demand in the world for diversification in supply chains and India can become a major player. The promotion of the manufacturing sector means forward integration with global supply chains and backward linkages with the MSME sector.

The domestic electronics hardware manufacturing faces a lack of a level-playing field vis-à-vis competing nations. It is assessed that it costs about 8.5 per cent to 11 per cent more to manufacture these items in India on account of lack of adequate infrastructure, domestic supply chain and logistics; high cost of finance; inadequate availability of quality power; limited design capabilities and focus on R and D by the industry; and inadequate skill development. Sunrise sectors need support in the initial stages.

Traditionally, we have tried to attract investors with investment subsidies like giving land at concessional rates and subsidy on plant and machinery cost at a fixed percentage of say 15 per cent to 20 per cent of price. Thereafter, if the unit does not properly run, the subsidy goes waste. The PLI scheme is result-oriented. The cash incentives will be paid only if the manufacturers make the goods. It is a better alternative from the Government’s viewpoint.

(The author is former Special Secretary, Ministry of Commerce and Industry)

Bengal’s revival

by Prafull Goradia / 26 November 2020It is possible to make a quick start in reviving the State’s economy without large investments but through governmental will and management

If I were still a resident of West Bengal, my first priority in the coming Assembly elections would be to retain the identity of our State. It should not in any way get compromised by Bangladesh or its concerns. We need to recall that on the eve of the Partition of 1947, Sir Abdul Rahim and the popular peasant leader, Fazlur Rahman, had come to Calcutta to convince Netaji’s brother Sarat Bose that a united Bengal should be the third dominion besides Hindustan and Pakistan. The Communist Party then began to support the idea of an undivided Bengal. Qaid-e-Azam Jinnah also backed it because a Muslim-dominated Bengal would willy nilly side with Pakistan rather than India.

When it comes to song, music, language and literature, all Bengalis take pride in them. But when it comes to memories, most Bangladeshis would recall their social oppression at the hands of the zamindars and their camp followers. Many remember that even when they were invited to dinner at wedding celebrations, they would be asked to sit separately and after meals were expected to clear their clay thalis. This hierarchical rift ran so deep that a united Bengal would eventually be torn from within. In conversation a few years ago with some acquaintances from Dhaka, I was surprised to find that they resented how East Bengal was not given Calcutta during the Partition, although the city was, as it were, a stone’s throw from Jessore. They believed it was unfair of the British to change the allocation at the last minute, and while conceding Lahore to Pakistan, they had done grave injustice to them. Calcutta was sought after because it was an economic hub and a port city; it supplied all the raw jute and the merchant princes of Kolkata reaped the benefit of jute mills and many other industries.

Mohammad Ali Jinnah was anxious to acquire Calcutta and the impression was that he was a capable negotiator. But obviously, he lost out, perhaps because his lungs were failing and his heart was set on getting Pakistan. The interests of East Bengal had a lower priority for him. Incidentally, the Qaid had never visited East Bengal until February 1948. The only so-called industry given to it was the Sylhet district, which was rich in tea gardens. Bangladesh has very few economic means, other than subsistence resources, such as rice and fish. That is why, it needs to follow the Japanese model of importing raw materials from overseas and converting them into products with high technology for export. It is difficult for any people to have such techno-entrepreneurial genius as the Japanese. The legend of Sonar Bangla is now threatened because six of the western districts no longer receive the rainfall of yesteryears and they badly need river water from India. The other misfortune is that most of the land is low-lying and the sea level is rising. According to scientists, in two decades’ time, 17 per cent of Bangladesh’s land area is expected to be submerged. All these factors make Bangladeshis the highest number of migrants to other parts of the world. But West Bengal has borne the brunt of this influx.

My heart throbbed with delight when a few years ago, Mamata Banerjee, with all the fury at her command, threw a sheaf of papers on the Lok Sabha Speaker’s table. She was then demanding an infiltrator-free West Bengal. The State has limited land and plentiful people and its resources have undoubtedly been stretched over the years, the refugees bulging that burden. Then the many industries — small, medium and heavy — that the State was proud of rapidly turned into industrial graveyards thanks to trade unions and poor management in years past.

Bengalis are a gifted people and certainly intelligent right down to the illiterate. If for nothing else, for their talent, the State deserves a better economy. A revival is overdue and it should soon set a new economic agenda. Setting up a new industry is like creating a brand, which would have to compete in this age of globalisation. On the other hand, education is a sphere in which Bengal enjoys a natural advantage as well as reputation. The first major thrust should be in the field of schools, colleges and universities. There is scope for developing a big knowledge economy because the catchment area can sweep UP, Bihar, Nepal, Assam and the Northeast, as well as Bangladesh. None of these regions is able to provide young people with quality education.

I would begin with medical studies. With efficient management and capable doctors, as many hospitals as possible across the State could be improved by deploying professional managers supported by medicos. Let the doctors do their own specialised work. Management and medicine/surgery should not be mixed up. Thereafter, medical colleges along with as many hospitals as possible could be set up. The significant investment would largely be in creating medical colleges. The World Bank could lend the money since the Government could guarantee the loans. There should be an option, wherever possible, for expanding the hospital and adding another college, considering the best of technology is already available in India.

There is a crying need not for ordinary schools but for excellent ones with hostel facilities. The New Education Policy (NEP) should be used as the lodestar for these schools to come up in the private sector with improved facilities. The land could be allotted by the State or there could be private-public partnerships. A similar strategy should be followed for colleges and universities. This would restore Bengal’s pride as the seat of intellect.

Next, the Government should attend to sub-Himalayan West Bengal. There is space for a splendid international airport in and around Bagdogra, which is near the town of Siliguri. This is the place for proceeding to either Darjeeling, Kalimpong or Gangtok in Sikkim. The most glorious mountains in the world form the backdrop of these hill stations. Darjeeling is at 6,000 ft, and another 6,000 ft above that is Sandakphu, which is motorable, too, and from where one can view the Everest on a clear day. World class hotel groups and enterprising airlines could be lured with promises of support, a stable law and order situation and assurance that any obstacles in their path would be removed. Himalayan Bengal would become a brand in itself for Nature has indeed done its best to give North Bengal an unparalleled beauty. It is, therefore, possible to make a quick start in reviving the economy of West Bengal without undue large investments but with governmental will and excellence of management.

(The writer is a well-known columnist and an author. Views expressed are personal)

No instant shot

by Opinion Express / 21 November 2020Our pandemic-hit economy will continue to misfire for some time but that doesn't mean analysts can write us off

A report by the global forecasting firm, Oxford Economics, predicting that India will be one of the worst-hit economies even after the worst impact of the pandemic is beyond us, has given Government baiters a new stick to beat it with. However, one must remember that several previous predictions of doom and gloom for India, either in terms of its caseload and number of deaths, has been proven to be premature fear-mongering. While the economic relief packages have been admittedly coming slow and staggered, one must not forget that several prominent economists have argued that India has not rushed into any action and is waiting out to see what long-term impacts the Coronavirus will have before taking major action on reviving aspects of the economy. Currently, some structural reforms have been made to spur development. So one should treat all reports of what will happen four years in the future with a major pinch of salt.

It is true that manufacturing and services have been hard hit by the pandemic and while ratings agencies and the Government might quibble about the exact figures, India’s economy will contract by around a tenth this year. Many sectors, such as aviation, travel and tourism, will take a good five-six years to return to prosperity that they had known and we are yet to see the worst of the jobs impact on the economy as various moratoriums come to an end. There are slight glimmers of hope though, including increased car and two-wheeler sales over the past few months. But there is also no doubt that a new tsunami of cases is upon us, whether we recognise it in the data or not, particularly in Delhi where public carelessness might have a fatal impact with specialised hospital beds beginning to run short. This has led to much speculation that Government authorities in India, like their counterparts across Europe, might need to declare a second shutdown. It would be prudent for forecasting firms, none of which saw the pandemic coming, to wait and watch as well and at least wait until the worst of the Coronavirus is past us before sounding the Doomsday alarms.

Seeding a new market

by Indra Shekhar Singh / 21 November 2020The Indian seed industry, as a sub-sector of the agri-inputs industry, has been the most vibrant in terms of innovation and growth over the past four decades

The Indian seed industry has made rapid progress over the past 50 years, maturing because of the ceaseless efforts of thousands of men and women, who have created a strong R&D base and given us a competitive advantage in ensuring quality. India is endowed with diverse agro-climatic conditions, high level of technology expertise, trained and skilled manpower, suitable land and abundant sunshine for agriculture. The country, therefore, has immense potential to emerge as the leading provider of seeds to the world. We can export varietals for all kinds of field crops, vegetables, forage crops and flowers.

However, considering the developments in terms of the new and emerging disruptive business operating models and processes aligned with innovative technology interventions, there is a need to invest in concrete initiatives for further strengthening the Indian seed industry as part of “Atmanirbar Krishi.”

The Indian seed industry, as a sub-sector of the agri-inputs industry, has been the most vibrant in terms of innovation and growth over the past four decades, contributing to a significant increase in productivity and profitability of farmers in India. The well-balanced seed quality legislative framework, set up by the Seed Act, the New Seed policy, 1988 and National Seed Policy in 2002, boosted private sector participation in a sector that had its foundations laid by public sector seed systems. However, much needs to be done in terms of further reforms and policy interventions.

The role of new technologies, like molecular-marker based selection approaches to fast-track breeding programmes for development of new/superior plant varieties, needs to be further strengthened as an integral part of the seed industry. Also biotechnological and molecular approaches can improve the quality assurance systems. An emerging area, which utilises biotechnology and nano-technologies and can contribute significantly to productivity and profitability of farmers, is seed treatment with biological inoculants. This can also be promoted on a large scale as part of seed-applied technologies.

The Indian seed industry can become a globally competitive, export-oriented and self-reliant industry, especially for several Asian, African, East European and South American countries, which share similar agro-climatic conditions like India as, with respect to international trade, most countries allow seed imports subject to the following: (a) Import permit based on sanitary and phytosanitary certificates and (b) Variety evaluation in the importing country to ascertain its suitability to the agro climatic conditions.

Currently, there are no significant export incentives available to the seed sector though the export potential is estimated at more than $ 5 billion per year based on various industry estimates. India can offer seeds for export to many countries with suitable sub-tropical and tropical agro-climatic regions in Asia, Africa, Eastern Europe and so on at affordable prices similar to our pharma and agro-chemical sector. The following incentives can help.

Incentive to the extent of 20 per cent of the seed value that is exported must be considered because in sectors like pharma and garments, similar incentives have been available for a long time to encourage exports in the initial stages. These incentives can be gradually brought down to 10 per cent after five years. A provision of Rs 100 crore may be adequate for the next five years and Rs 100 crore for the next six to 10 years.

Reimbursement of the cost of variety evaluation in any foreign country is a progressive policy. It may be considered here, too, as the seed companies have to incur heavy expenses for variety evaluation, which is a pre-condition for obtaining export orders. This expense needs to be reimbursed at least to the extent of 75 per cent by the Government. A provision of about Rs 100 crore may be adequate for the next 10 years for meeting plant variety evaluation expenses for export purposes. Seed manufacturers add to economies of the importing countries and help get more foreign reserves into the country. Hence they should be rewarded with up to 30 per cent subsidy.

India has lacked a seed export promotion council for a long time. The Government, under the trade and export promotion council, should institute one with industry representatives and ensure that seed exports amount to 10 per cent of total agriculture exports.

India has three major seed hubs in the country. But given our vast agro-climate, we can cater to demands from Africa to ASEAN countries. The Government needs to allow Indian and foreign seed companies to breed seeds for export purposes in special agro-zones. These zones may function like SEZs. They need to be equipped with dry docks, good transportation, seed testing facilities and so on to facilitate swift exports. A single window clearance counter can be established for fast tracking permissions.

An “Atmanirbhar Krishi” or self-reliant seed sector needs the SAARC markets and good economic relations between SAARC countries. The Government and industry need to step forward and create a SAARC seed forum, which will help ease-of-doing-business in the sub-continent and also provide avenues for international trading without restrictions. This body should strictly be an economic one for policy and regulatory advocacy among the SAARC countries. The Indian seed sector will grow immensely if we can spearhead this drive.

Finally, climate change is causing a rapid shift in the demands of seeds globally. Very soon, many nations won’t have the financial resources to evade this crisis. But we can be a hub for seed research for the world. Our versatile climate allows us to research and co-evolve new varieties that may be suited for many countries. For even one or two varieties at the right time can change the fate of the nation and bring millions of dollars into India. Hence the Government needs to provide development grants to Indian R&D companies so that they can track future challenges, assess demand and create a seed bank for Africa, Latin America and ASEAN countries. The Government may also partner with African nations to outsource their seed R&D to us. This would boost innovation here while providing lesser developed nations an access to cheaper research and seeds.

(The author is Director, Policy and Outreach, National Seed Association of India)

Much ado about nothing

by Shshank Saurav / 02 November 2020The IMF flags various challenges for the Indian economy but a temporary fall in GDP per capita as compared to Dhaka is certainly not among them

The International Monetary Fund’s (IMF’s) World Economic Outlook released recently caused a sensation after it highlighted that Bangladesh’s per capita Gross Domestic Product (GDP) could surpass that of India’s this year. Our economy is expected to contract by a little more than 10 per cent and our per capita GDP, too, is projected to decline to $1,877 as against $1,888 for Bangladesh. This naturally created a flutter as historically our per capita GDP has been higher than our neighbour’s and the current decline is an exceptional occurrence caused by the pandemic-induced lockdown. However, the report also suggests that we will overtake that tiny nation next year and India’s per capita GDP in Purchasing Power Parity (PPP) terms will stand at $6,284 while it will be $5,139 for Bangladesh.

Though overall GDP numbers can be a good measure of the economic performance of a country, the GDP PPP is a better indicator if someone is doing a per capita analysis. This is because PPP eliminates the differences in price levels between countries and also considers the impact of exchange rates. Hence, the GDP PPP is generally used to compare the living standard between countries. However, it is absurd to compare because the Indian economy is way bigger than Bangladesh’s. For instance, our forex reserves are more than $555 billion while its reserves are a puny $39 billion. Moreover, per capita income also involves another variable — the overall population — and is arrived at by dividing the total GDP by the total population. Bangladesh’s economy has been witnessing massive GDP growth since 2004 but even then this pace did not alter the relative positions of the two economies between 2004 and 2016. This was because India grew even faster than Bangladesh. But 2017 onwards, India’s growth rate slowed while Bangladesh’s growth accelerated. Over the same period, India’s population grew around 21 per cent while Bangladesh’s population was just under 18 per cent. And if mere per capita GDP is the criteria for economic supremacy, then Sri Lanka and Bhutan have done better compared to many larger nations.

Plus, a detailed analysis of the report reveals that long- term growth projections for India are better as compared to China. Projections for next year stand at 8.8 per cent for India and 8.2 per cent for China while the gap consistently increases from 2022 onwards. Also, inflation is a key factor in deciding the lifestyle and saving potential of the common man and India’s consumer price inflation is the least among South Asian countries.

So, if we compare ourselves to our Asian neighbours, then everything looks fine. But there are a few red flags which the report throws up. First, is the higher debt-GDP ratio of the country which is increasing on a year-on-year (YoY) basis. Debt as percentage of the GDP stood at 68.77 in 2015 and it is expected to cross 89 per cent this year. This is much higher than the 61.7 per cent debt level of China. A higher debt increases the interest payout and leaves fewer resources for productive purposes. Though there are various factors involved while determining the sovereign credit rating but for the sake of perspective, it is pertinent to highlight here that recently Moody’s downgraded India’s rating by one notch to BAA3, the November 2017 level. We can argue that many developed nations have a higher debt-GDP ratio, but then they have a formalised economy which gives their Governments the ability to raise resources quickly. Something which we don’t have.

Second, our GDP is declining and revenue as percentage of the GDP is decreasing, too. It stood at 20.23 per cent in 2018 and then it came down to 19.3 per cent in 2019. It is expected to decline further to 18.08 per cent this year. This is primarily coming from the Corporate Tax rate cut announced in 2019. Sadly, the objectives of the tax cut were not achieved. Even a Reserve Bank of India report released a few months ago highlighted the fact that the tax rate cut has not translated in increased investment. This decline in revenue will increase the reliance on non-tax revenue with major focus on disinvestment, which has its own complications.

Third, India’s Gross National Saving (GNS) has declined significantly from 31.06 per cent of the GDP in 2015 to 28.8 per cent in 2019 and is expected to fall further. In comparison, China’s GNS-GDP ratio is more than 40 per cent and domestic savings are necessary for capital formation in a developing economy like ours. Policy makers are facing major challenges in increasing consumption and savings, both of which are vital for the growth of the economy.

The IMF report highlights various challenges facing the Indian economy but a temporary decline in GDP per capita as compared to Bangladesh is certainly not among them. Indian policy-makers need to come out of their slumber and shed their complacent attitude to reviving the economic growth that we have lost due to the Coronavirus pandemic.

(The writer is a Chartered Accountant and an economic analyst)

Make the right policy choices

by Kumardeep Banerjee / 30 October 2020A continued prosperity for nations will only be achieved by allowing and championing a global open market for trade, goods and digital services

It is festival time globally, and not just the religious and fun variety but also the vital festival of democracy or elections. It is for the first time in our lifetimes that festivities, mostly associated with huge crowds jostling to reach the ballot box or bedi (the pedestal on which the idols of deities are kept), are taking place in the shadow of a raging global pandemic. Forced departures from well-known rituals associated with festivals make these times a case study for future generations. Many would have seen a video on social media of an idol being immersed using mechanised trolleys, with least human intervention, in the recently-concluded Durga puja festivities. Now switch to the theatre of democracy in Bihar, where Assembly elections are being held. The common thread between the two festivals is, technology. Bihar, would perhaps be the first State in the country where technological interventions played a key role in the elections.

First, the Election Commission (EC) allowed online filing of nominations for candidates and many political parties chose to reach out to their constituents through virtual rallies and put up huge LED walls for public viewing. Given the absence of many veterans active in Bihar elections for at least three decades, most of the young scions of the colourful, vociferous and politically-influential families were suddenly catapulted to the centrestage of a new narrative. This young brigade of Biharis, technologically more versatile than their parents, sought votes on issues. Something hitherto unheard of in a State, known for its divisive caste and religious biases. It was surprising to see rival candidates promise lakhs of jobs to young voters in a State grappling with the problem of the jobless migrant labourers.

The most welcome aspect of this election has been the reliance on technology in a State which could well be a case study on the digital divide between India and Bharat. Many statisticians will point to a survey which revealed that more than half of Bihar’s women and around 40 per cent men have no access to mass media. This, when extrapolated over digital media, means a significant part of the population can either be completely insulated from the impact of technology or could be the next addressable unconnected millions, who need to be put on the information technology expressway of prosperity.

Now let’s jump across the Pacific to the US, which, too, is about to witness one of the fiercest and cacophonic elections on November 3 amid the Covid threat, deaths and economic destruction. The common binary binding Bihar elections, Durga Puja festivities and US elections is again, technology. After all, the new dominance game and the race to be a global superpower is now increasingly getting defined by your first tap on a smartphone, first digital payment/electronic transaction, first contact-free shopping for world-class brands from the comfort of your home and perhaps the first digital date after months of trying to understand each other’s typos and abbreviated texts.

Therefore, restrictions on digital applications, depending on the country of origin, to applying the same principles to hardware solutions in technical infrastructure, to forming an alliance of like-minded technology fraternity of nations were some of the key highlights in the election campaign of the two presidential candidates of the world’s richest democracy. What it also highlighted was the fact that increasingly, the physical restrictions (read policies) of trade and commerce dominating economic relations between a bunch of nations will now be enthusiastically copy-pasted in the digital arena to prevent loss of sovereign powers and dominance at the global high tables.

Covid has put the spotlight on public policy issues, which, till February, were still in advanced stages of intellectual discourses. It has challenged our ability to adapt and eventually recover from the disease. And the only sector which has truly helped this advancement is technology. It reacted quickly and ensured teachers, parents and children were handed online course materials for seamless academic learning and doctors were given online tools for initial digital health interventions for patients. It gave the Government effective platforms for interaction and empowered it to push critical policy goals. Technology enabled digital live darshans of beautiful but deserted pandals and online delivery of prasad for the religious, too. If the human race has been pushed ahead by three decades in one stroke by the lockdown and technology has taken centrestage, it is also time to think and refresh many global policy challenges and perhaps release an update. Policymakers have to realise that imposing strict restrictions, based purely on case-by-case models, and having a physical worldview of digital policy issues can be self-defeating in the long run. A continued prosperity for nations will only be achieved by allowing and championing a global open market for trade, goods and digital services. It must be kept in mind that the new normal for policy-making at sovereign-level negotiations must be dictated by a set of principles. This must be compulsory in all digital agreements between consumers and technology providers, governments and their counterparts across borders. A multi-lateral approach must be championed. It is time to click on the right button.

(The writer is a policy analyst)

New strategies for the new normal

by Swapnil Soni | Kosha Joshi / 22 October 2020This outbreak serves as a reminder for retailers to be more proactive in planning and resilient in their response to future disruptions

The Indian retail industry is a highly competitive, $800 billion market with a Compound Annual Growth Rate (CAGR) of 12 per cent. Out of that, the share of online retail is $32.7 billion with a CAGR of 31 per cent. Smartphone penetration, brand consciousness, demographics and policy support are the factors transforming and pushing this industry towards omnichannel retailing.

Omnichannel retailing is a fully-integrated approach to commerce, providing shoppers a unified experience across all channels or touchpoints, including online and offline. It offers consistent merchandise and seamless interaction between online and offline channels, thus combining the benefits of both. However, the pandemic and subsequent national and local lockdowns have greatly impacted both supply and demand. The supply side was hit by administrative restrictions and limited resources while demand, too, remained subdued due to job-losses, salary cuts and restrictive spending. In such a situation, an agile response is needed for swift operations, customer satisfaction and surviving in the post-Corona era.

Evolving consumer behaviour: Though retail has undergone many significant disruptions in the past, perhaps none has shifted consumer behaviour as rapidly as this contagion has. The changes are happening due to factors like challenges in personal situations, preferences towards local products, precautionary measures against the virus and rising digital awareness — a by-product of promotion of contactless transaction.

Even in the unlock stage, consumers are hesitating to visit stores and while exercising social distancing measures, many uninitiated customers are moving towards online retailing. For example, many senior citizens are opting for online grocery shopping as a precautionary measure. Use of services like contactless digital payments, social commerce and virtual consultation are also seeing a rise.

Many of these behavioural changes will continue even after the pandemic is over. McKinsey and Company cited this as “consumer behaviour shift.” For example, people will get used to the comfort of home delivery, ease of digital payments, varieties offered by online markets and so on. Retailers need to draw insights from these changes and rebuild the consumer confidence as the new normal continues.

Financial skills: Revenue is sharply dropping for many categories. Even though store profit has gone down, retailers need to pay rents, salaries and so on. Hence, at this point it is necessary for them to optimise cost and curtail the offerings to profitable items. In the long-term, as demand picks up, it would be prudent to invest in omnichannel fulfillment as means to financial resilience.

Accept the new normal: Social distancing, safety and hygiene procedures will be here for a while. The best way to go forward is to accept the new normal and the complexity it will bring to decision-making.

Consumer connect: Now more than ever, it is must for retailers to connect and communicate. Consumers will definitely like to know what a business is doing to ensure their safety, for delivery as well as in stores. Despite the pandemic, customers will need timely deliveries of their order. So, in case of item shortages or delayed fulfillment, it is necessary to explain the cause and convey the commitment.

Extra activity: First and foremost, retailers need to adapt to safety regulations, sanitisation procedures and regulatory directives at the country, State and municipal level in various phases of the unlocking. They need more dynamic inventory and logistics planning to meet the fluctuations both in demand and supply, plus a connect with employees regarding their health and financial well-being. This will prevent attrition and business continuity.

Infrastructure: The Indian online retail infrastructure is in an intermediate stage. The pandemic just exposed the flaws and inefficiency which were already there. Retailers should review the location of warehouses, delivery centres and their distributors to compute the risk of supply chain disruptions. The partnership with local grocery stores will help retailers to ensure timely contactless last mile delivery even during a crisis. Retailers also need to re-imagine in-store experience, considering customers’ safety and efficient operation with reduced staff while complying with social distancing norms.

Technology skills: Technology allows retailers to have relevant information and visibility throughout the supply chains, resulting in timely communication with all the stakeholders. Businesses will need secured, informative and intuitive shopping apps, which can balance for the lack of store visits. Also, Artificial Intelligence will continue to make a big impact in this sector to predict real-time consumer demand, optimise inventory and manage backorders, thus ensuring operational agility.

Also, Smart Mirrors and Augmented Reality can help build a store-like environment in the virtual world, ensuring safety. This way, retailers and associated stakeholders need to ramp up technological skills and infrastructure as they enter a post-pandemic era. As of today, India is among the top countries with the highest number of Covid cases and there is no end to the contagion in sight. Even the countries, where the outbreak seemed to be in control initially, are experiencing a second wave. This has caused supply and demand disruption and jolted the market ecosystem.

Hence, it is certain that retailers, that are an integral part of the demand-driven economy, need to be financially prudent, fast in their response to the new dynamics and ready to collaborate through the value chain to hthrive during this crisis and subsequent periods. As with many sectors, it is likely that retail will see a regime shift and consolidation. Smaller and financially-struggling businesses might face difficulty in surviving this crisis. At the same time, retailers with a unique value proposition will come out stronger. This outbreak serves as a reminder for retailers to be more proactive in planning and resilient in their response to unprecedented disruptions in future.

(The writers are Senior Research Scholars at the Indian Institute of Science, Bengaluru.)

Restarting Jet

by Opinion Express / 21 October 2020With only a few details public and no dates set for resuming fights, there is no guarantee that this will succeed

The bid to take over the remaining assets and brand of Jet Airways by Dubai-based real estate entrepreneur Murari Jalan and American private equity firm Kalrock Capital has been accepted by the lenders. Even though they will have to accept a massive 90 per cent haircut on their outstandings from the airline, the fact that they will get something is a lot better than what they faced with Kingfisher. Former employees of the now grounded airline as well as other unsecured creditors, everyone from those who provided taxi and catering services to passengers with tickets for flights that never took off, are hoping that the new management will clear their dues as well. Unfortunately, while the new management might absorb some old employees and even executives, it does not hold any obligation to clear these unsecured dues. The new owners could clear some dues in order to build goodwill but of the estimated Rs 40,000 crore owed by Jet Airways to various creditors and employees at the time it suspended operations in April 2019, much of it will never be seen again.

This deal is being spoken about as a success of the Insolvency and Bankruptcy Code (IBC) that was introduced by the Government in 2016. Some even suspect that the Government pushed this deal through to highlight that the IBC can be a success as several other high-profile cases are stuck. That said, the proof of the pudding is in the eating and the proof of an airline is in the flying. With few details public, there are no firm dates on when this ‘new’ Jet Airways can fly again. As the aviation market globally is in the doldrums, one also questions whether this is a smart time to launch an airline when customer demand is less than half of what it was this time last year. Yes, it will be easier than it would have been in February to get slots and even lease new planes but the new management should not have misplaced optimism about “customer loyalty.” Restarting a brand, any brand, and particularly a service brand after a period of not operating is not easy and customers are extremely fickle. And with the likelihood of one, maybe even two airlines in India potentially falling victim to the pandemic, thanks to stretched balance sheets, things might actually get very difficult for the new ownership. That said, we wish them all the best and hope that they can succeed, and hope is a very powerful thing these days.

FREE Download

OPINION EXPRESS MAGAZINE

Offer of the Month