37 percent Indian companies who were researched to spend more on travel and entertainment this year; 40 percent feel Indian businesses are expected to invest more than last year in improving administrative process efficiency.

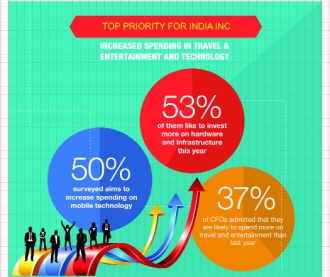

Travel and entertainment are the two segments which have been given a thumbs up by Indian finance executives as they are likely to increase spending. This is followed by investing in improving administrative process efficiencies and investing on mobile technology and hardware and infrastructure in 2018 to help meet their business priorities. According to the 11th Edition of the Global Business & Spending Outlook Survey, commissioned by American Express and conducted by Institutional Investor Thought Leadership Studio, 37 per cent of the CFOs surveyed that they are likely to spend more on T&E than last year, whereas 50 per cent maintained that they are likely to keep the spending same as last year.

The annual cross-industry survey conducted among 870 senior executives across 21 countries with worldwide revenue of more than US$500 million, states that 33 per cent of the Indian CFOs surveyed are likely to spend more on transportation/logistics and 53 per cent on hardware and infrastructure while half of the senior financial executives (50 per cent) aim to increase spending on mobile technology. About 40 per cent of the CFOs surveyed said that they are likely to invest more than last year in improving administrative process efficiency (e.g., streamlining financial, account payables, or procurement process) to help meet business objectives.

It is noteworthy that 90 per cent of the senior finance executives felt that improving cash and working-capital management (including payables, receivables, and inventories) is more important for their businesses this year as compared to last year. Over 60 per cent of the executives said that use of credit (e.g. revolving credit lines, corporate card, “float”) and ability to negotiate better payments terms on payables and receivables as well as volume discounts on purchases with suppliers and customers would yield substantial financial benefit to the company.

Sharing her views, Saru Kaushal, vice President and general manager, Global Commercial Services, American Express Banking Corp., India, said, “India is leading the way in terms of both business confidence and investments. Efficiency has become the keyword as companies take a back-to-basics approach and focusing on the fundamentals — better serving customers and meeting their needs, developing new products, entering new markets and prioritising business transformation and innovation. Businesses are reiterating the need for increasing spend on T&E, optimising cash flow and using it judiciously to grow and protect the business.”

Sharing economy is the name of the game

About 87 per cent of the respondents believes that commercial innovations of the so-called “sharing economy” (eg. those used by ride-sharing services like Uber or lodging services such as AirBnB will have a substantial impact on their industry in the next five years with 60 per cent executives agreeing that their company’s travel policy allows employees to use sharing economy services for lodging or transportation when traveling on business.

Meeting Customer Needs is Top Priority; Spending Plans Centre on Technology

Meeting customer needs better is a top priority for survey respondents in India (63 per cent). Companies are also most likely to focus on cyber-security and the protection of customer, supplier and employee data in the next two years.

Changing role of CFOs

Interestingly, the survey also reveals that 53 per cent senior finance executives see their function as that of a strategic advisor — not as a leader of strategy, nor as a mere supporter of it which in turn speaks of the significant evolution of the role of the finance executive.

Workforce increase anticipated, focus more on retaining top talent

Senior financial executives in India plan to increase their companies’ workforce in the year ahead. In the coming year 97 percent of survey respondents anticipate an uptick in their companies’ headcount. Last year, 20 per cent expected headcount to grow by 10 per cent or more. However, employee growth of 6 per cent or more rose to 77 per cent this year, up from 50 per cent last year. In an effort to attract and retain top talent, companies are also likely to improve the day-to-day working environment of their employees, offer more flexible work schedules and locations and expand career development programmes.

Writer: Team Viva

Courtesy: The Pioneer

OpinionExpress.In

OpinionExpress.In

Comments (0)